Operations and Performance

/

Article

March 01, 2023

A new study from Kearney, in collaboration with Amazon Web Services (AWS), reveals that forward-thinking COOs are setting their sights on making operations more resilient, investing in innovation and sustainability, and building groundbreaking partnerships with their suppliers.

Post-pandemic, the fact that we will never go back to normal has become a well-worn adage. In a world where constant transition and disruption are the only norms, organizations are challenged from every angle. Old rules have been left by the wayside as leaders seek new ways to navigate increasingly choppy waters—which, along with a slew of difficulties, have brought fresh opportunities for businesses to revitalize themselves.

Nowhere is this more evident than in operations management, the nerve center of organizational capability. Today’s chief operating officers (COOs) have become the go-to individuals for answers as to how sustained resilience, if not survival itself, can be achieved.

Over Kearney's nearly 100 years in consulting, we have seen operations evolve from fully integrated to outsourced to offshored, and now, an entirely new landscape is forming. But what does this mean for operations and supply chains? What are the prevailing themes? Which topics are taking precedence? And what’s keeping COOs awake at night?

Getting inside the minds of today's top COOs

Kearney designed its inaugural COO study in collaboration with AWS to address these issues and more, questioning more than 100 leaders from some of the world’s top firms about the future of operations: what the emerging supply chain looks like from a strategy, footprint, and talent perspective; which actions are generating the biggest impact against external threats and pressures; what expectations there are around growth (including potential barriers); where investment decisions are being prioritized; and how the topic of resilience is shaping the value chains of tomorrow.

Here’s what we found:

1. COOs are optimistic about the future.

2. Sustainability is becoming more important than lowest cost for suppliers.

3. Resilience is becoming embedded into the decision-making process.

4. A twist on globalization leads to an optimized mix of production locations.

5. Digital and environmental, social, and governance (ESG) are the top investment priorities.

Our COO study methodology

In Q4 2022, we surveyed more than 100 COOs from large organizations, including a high representation from Fortune 500 companies. Of the executives who participated in our study, 85 percent were from firms with annual revenues of more than $500 million.

The breakdown of responses across industries was as follows:

· Consumer and retail (including food): 22 percent

· Financial services: 17 percent

· Professional and business support services: 14 percent

· Chemicals and industrial: 11 percent

· Automotive and parts: 7 percent

· Utilities, oil, and gas: 7 percent

· Communications, media, and technology: 6 percent

· Transportation and travel: 6 percent

· Health: 4 percent

We asked questions relating to seven topics that have a major influence on operations today:

· Margin protection and inflationary pressures

· Macroeconomic threats, such as tariffs and a recession

· Sustainability

· Sources of growth

· Digital and technology

· Resilience

· People and talent

Below, we dig deeper into the five major findings of our study.

Our inaugural COO study surveyed more than 100 executives from large organizations, including a high representation from Fortune 500 companies.

1. Optimism is the watchword in operations

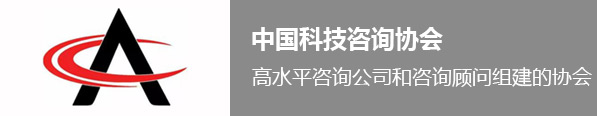

After a period of confidence around 18 months after the start of the pandemic, with inflation now in full flight and recession lurking in the wings, some reports suggest that business leaders have reached “record pessimism” when it comes to the global economy and their own companies’ growth prospects. However, perhaps unexpectedly, it seems that these fears are not troubling those charged with steering organizations through the mire: their COOs. Despite the headlines, on average, we found that individuals in these roles are anticipating strong growth in their companies—from 10 to 19 percent—over the next 12 months (see figure 1).

Organizations are prioritizing investments in new customers (74 percent), new channels (69 percent), and new products (68 percent) to fulfill these expectations, while innovation and new products, increased operational efficiencies, and geographic expansion stand out as the major themes expected to fuel the anticipated growth.

We believe these results denote the arrival of a new era for supply chains. In the past, during periods of economic uncertainty, the chosen response was most often to cut costs and batten down the hatches. By contrast, today’s COOs are optimistic because they know what’s becoming possible in end-to-end supply chains. Thanks to advancing technologies, including cloud solutions, they have access to previously unknown levels of transparency, control, decision-making, and operational efficiency. As a result, they are going on the offensive in the pursuit of growth. For some, this translates into an intent to increase spending over the next six to 12 months, even as recession threatens. For others (around 20 to 24 percent of our respondents), investments in growth will partially be offset by a minimal or moderate reduction in spending. Only 8 percent intend to significantly cut expenditures over the next six months, with even fewer (5 percent) indicating the same over a 12-month timeframe.

While these findings might be somewhat surprising, they demonstrate that operations chiefs not only know the right levers to pull, they also have a confidence in the new capabilities and toolsets now available to take their organizations into advanced territory. Equally, our study indicates that CEOs and COOs need to be closer than ever if they are to successfully define and deliver on their companies’ strategies. Growth and optimism aside, the COOs in our study confirmed a number of trends that we have already observed in our client work and ongoing market analysis.

2. Sustainability is becoming embedded in procurement and supply chains

It’s generally accepted that organizations are facing mounting pressures to adopt sustainable practices and place ESG concerns at the heart of their strategies. As such, there’s little surprise in learning that accountability for these metrics has shifted out of HR and into the operations hot seat.

The operations leaders that we surveyed are mainly focused on the environment dimension, investing in infrastructure such as recycling facilities and reverse logistics, with energy savings and renewables, followed by climate change and mitigation—the top priorities for 66 percent and 63 percent of COOs respectively.

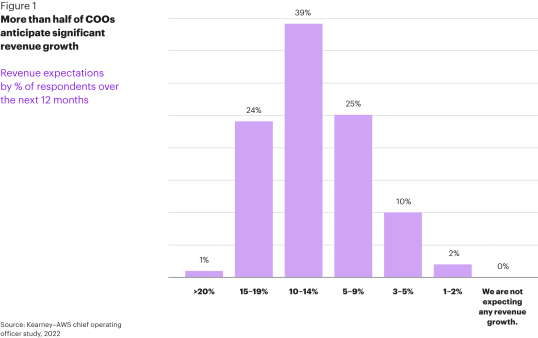

However, the greatest potential returns for organizations when it comes to sustainability are to be found in their supply chains. This is having an impact on the nature of procurement, whereby lowest cost is losing ground to value and sustainability. Today’s COOs are not focused on suppliers that offer them the cheapest deals. Instead, they increasingly want to draw on long-term partnerships that offer joint innovation, supplier diversity, and sustainability as well as the entry-level requirement of available capacity (see figure 2). In fact, forming alliances with suppliers is seen as the foremost strategy for countering rising inflation for 59 percent, over and above passing on price increases to customers (52 percent) or embracing design thinking (50 percent).

3. Resilience evolves into an organizational imperative

The notion of resilience is another concept that has entered the general lexicon when it comes to organizational success in today’s climate. But is it a talking point, or are firms genuinely taking concrete action to proactively use tech, digital, data, analytics, and so on to strengthen their position and shore themselves up against future disruption? Going on the answers to our survey, it’s clear that in operations at least, resilience is much more than an aspiration. In fact, 56 percent of COOs now consider it a top priority in its own right, and it has been operationalized and quantified as a KPI in 80 percent of their organizations.

Resilience has also become embedded in key decision-making processes: 36 percent of COOs say it is a primary KPI, on par with other key measures such as ROI. Another 28 percent include it as part of ROI calculations, and 20 percent treat it as a secondary KPI. A further 14 percent say resilience is included as a consideration but is not quantified, and only 2 percent say it is not reflected in their core decision-making.

4. A twist on globalization leads to an optimized mix of production locations

Today’s firms are as focused on getting the right manufacturing footprint in place and making sure it aligns with their operations strategy as ever. In fact, 85 of COOs say this is the case for their own companies. However, what has changed is the level of detail with which COOs can now control their end-to-end supply chains.

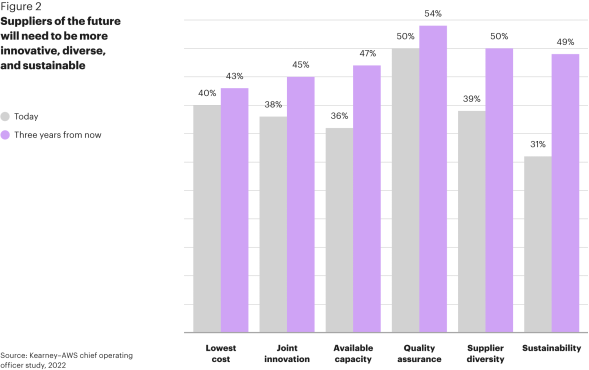

There has been a step change in shoring: rather than pursuing big-ticket, one-size-fits-all strategies, COOs are employing much more granular tactics and choosing an optimum mix of production locations for specific parts of their supply chain operations.

This new approach was reflected in our study. Of the changes made during the previous 12 months, 44 percent of COOs say their companies had been nearshoring their operations, while just over half (51 percent) had been engaged in offshoring production, and 64 percent of companies reshored manufacturing activity, suggesting that whatever the chosen mix, optimizing the production footprint is viewed as a way of building resilience (see figure 3). By contrast, only 15 percent say this had not changed during the previous year.

As for what makes the difference when selecting a country or region to source manufactured goods from, ease of doing business is the most important factor for the overwhelming majority (82 percent) of COOs, while intellectual property protection is the second most important consideration (71 percent).

5. Investment decisions continue to prioritize digital and ESG

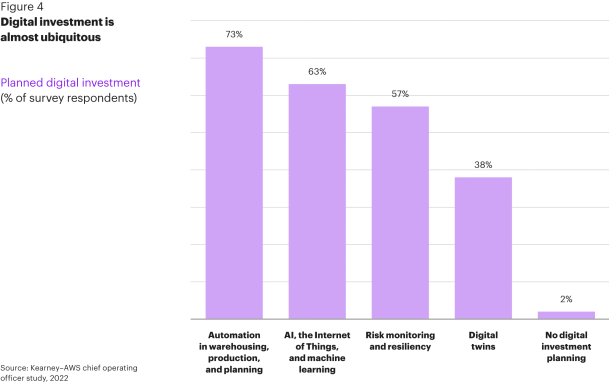

Along with sustainability, digital remains a universal priority as a means of improving supply chain operations: 98 percent of COOs say their companies are actively investing in digital, automation, and AI. Digital investment priorities range from automation in warehousing, planning, and production (73 percent) to artificial intelligence, the Internet of Things, and machine learning (63 percent), risk monitoring and resiliency (57 percent), and digital twins (38 percent) (see figure 4). Only 2 percent say they have no plans to invest in this area.

Interestingly, while manufacturing lags other supply chain functions in terms of digitalization, this is the area where companies anticipate the most significant strides over the next 12 months, over and above planning, sourcing and procurement, delivery, and sustainability—although it could probably be argued that embracing digitalization in any of these categories will have some impact on sustainability.

These results demonstrate that COOs are taking a pragmatic approach and investing first in areas that will deliver the biggest payoffs—for example, first creating the wealth of data and detailed, real-time operations insights to feed analytics and other advanced tools rather than jumping the gun on hot-ticket technologies such as digital twins before their organizations are ready for them.

It’s time to regenerate some optimism in the boardroom

Our world is changing rapidly, forcing organizations around the globe to reevaluate what it means to be successful and acknowledge the changing role of operations in delivering on their strategies. Whether or not there’s truth in the CEO pessimism stories, our first COO study reveals that the mood among this group is more buoyant. Visionary COOs have seized the moment and are starting to redesign their operations to embed resilience, invest in innovation and sustainability, and build groundbreaking partnerships with suppliers, recognizing that these are the core ingredients to take their organizations into the future. They understand the need to keep adapting: to cultivate a smart, self-healing ecosystem that truly has operations at its heart. In short, right now they are in the business of regeneration.

Staying ahead of the curve

The most successful companies work proactively to stay ahead of the curve. Kearney and AWS can help you do just that by building a resilient supply chain, fortified by the latest cloud technology, that prepares your company to anticipate disruptions, tackle headwinds, and—most important of all—keep your promises.

Interested in learning more about our operations and performance expertise?

Learn more

Authors

![]()

Suketu Gandhi

Partner

![]()

Michael F. Strohmer

Partner

Marc Lakner

Partner

Tom Adams

Director, Business Consulting & Advisory Partners, Amazon Web Services (AWS)