Embracing volatility

Global Economic Outlook 2023–2027

Global Business Policy Council

Research report

2H 2023 update

Foreword

In our 1H 2023 Global Economic Outlook, Lingering aftershocks, we highlighted the long tail of shocks that began months and years prior. The Russian invasion of Ukraine and resultant energy and commodity dislocations, and the legacy of the COVID-19 pandemic, including sticky inflation and enduring supply chain bottlenecks, were just a few of the factors we examined. Six months since this publication, these issues endure—and the volatility they represent shows no signs of abating. The Russia–Ukraine war seems unlikely to be resolved in the short term. Geopolitical tensions persist, particularly between the United States and China. And incidents of extreme weather are taking place with alarming frequency, including deadly wildfires in Maui this past August. As one participant noted at our 2023 CEO Retreat in Cannes, “we see real volatility— financial volatility, financial asset volatility, and volatility in bonds, stocks, and risk premiums—as the effects of climate shocks and geopolitical disruptions are increasingly felt.”

What is to be done? While there are signs that central bank interventions to bring down inflation have yielded some successes, it remains an open question as to whether a recession, mild or otherwise, will be required to bring it down to 2 percent targets. Asia remains the fastest-growing region in the world, yet China’s economic slowdown continues to drag down global growth prospects. And technological advances, particularly in artificial intelligence, represent a significant wildcard. It can be reasonably argued that AI could unlock unprecedented global growth as greater efficiencies are realized at scale. But the technology could also result in massive disruption—including the spread of mis- and disinformation, worker displacement, sharp increases to inequality, and countless other unintended consequences.

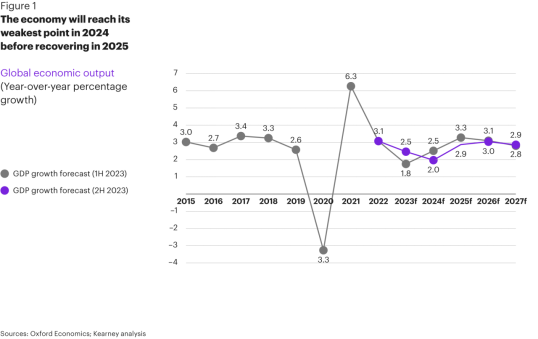

Amid these and other shifting factors shaping the global economy, we have downgraded our projections for 2023–2027 global growth from 2.7 percent to 2.6 percent. We do anticipate better-than-expected growth in 2023—up to 2.5 percent from our previous projection of 1.8 percent—based on strong consumer spending and tight labor markets. However, we then expect growth will drop further to 2.0 percent in 2024 as the effects of monetary tightening are increasingly felt, before a modest rebound approaching 3.0 percent in the last three years of the forecast period.

We have also reassessed the factors we believe will have an outsized impact shaping the five-year outlook. This includes an examination of the 2024 US presidential election and its implications for geopolitics, the costs of climate change to the global economy, the role of central banks in taming inflation, demographic trends and their impact on labor market imbalances, and the implications of AI for the global economy. To account for the range of uncertainty inherent in each of these factors, we have refreshed our scenario analysis, updating the narratives and econometric analysis first published in April.

The scenario analysis suggests that volatility will persist—to one degree or another—regardless of the future that unfolds. We have entitled this 2H 2023 Outlook Embracing volatility to reflect our view that business leaders have no choice but to accept and lean into this reality. As one participant noted at our 2023 CEO Retreat, “successful firms invest into volatility and innovate into volatility. If they fail to do this, we will not end up with real performance, just more debt …. The most dangerous thing for businesses to do is to sit on their hands and be defensive.” For the sake of business interests—as well as for the global economy—business leaders would do well to abide by this suggestion.

As always, we welcome your views on our analysis.

Erik R. Peterson

Partner and managing director

Global Business Policy Council, Kearney

Summary of key conclusions

When will the global economy begin to see renewed growth? The outlook for 2023 has improved compared with earlier projections from April of this year, though growth through 2027 remains anemic. We expect average growth output of just 2.6 percent over the 2023–2027 forecast period, down from 2.7 percent from the previous projection. China’s declining growth, the threat of mounting sovereign debt distress, and contracting manufacturing contribute to the expected slowdown.

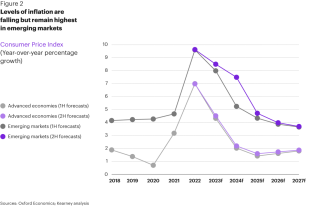

What is the trajectory for inflation, and where will interest rates land? Weaker commodity prices, slowing growth, and easing supply chain pressures will help inflation recede in most economies. Though the average inflation forecasts for advanced and emerging economies are higher than anticipated in the 1H 2023 Outlook, inflation rates now appear to be peaking and are projected to fall to target levels by the end of 2024/early 2025.

What is the employment outlook? Unemployment is predicted to decrease over the 2023–2027 period, averaging 6.5 percent and leveling out after a peak in 2024. Shrinking working-age populations threaten key markets, including China, South Korea, and Italy, and present a potential risk to the outlook. These potential risks could be mitigated by Africa’s growing labor force power and the potential for technology and automation to balance labor markets.

What will the largest economies be by 2027? The United States continues to be the world’s largest economy, followed by China and Japan. China is rapidly closing the GDP gap with the United States but will not surpass it by year end 2027. India, previously the sixth-largest national economy, will become the fourth largest, overtaking both Germany and the United Kingdom.

What is the outlook for globalization? Sixty-six percent of investors say they expect an increase in globalization in the next three years, though concerns around rising protectionism loom. A proliferation in digital trade and services, notably in telecom and IT, could drive globalization. However, regionalization and policies to advance domestic self-sufficiency are also expected to intensify, changing the nature of globalization.

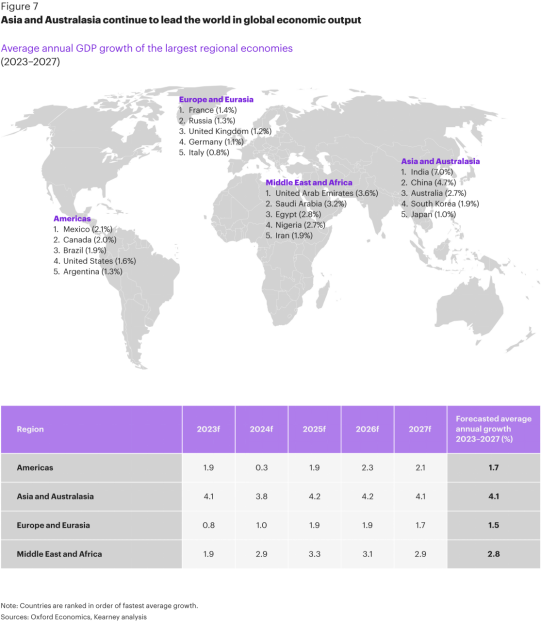

Which region will drive economic output? The Asia and Australasia region continues to be the world’s growth engine. Output growth in the region is projected to average 4.1 percent through the forecast period, down slightly from 4.2 percent in our 1H 2023 outlook. India’s growth continues to be a driving force behind the broader regional expansion, with a projected growth rate of 7.0 percent. Despite some slowing, China also maintains a steady output rate of 4.7 percent.

What key factors will shape the economic outlook through 2027? Over the next five years, five factors will have an outsized impact on the direction of the global economy. These include geopolitical turbulence creating further fragmentation and conflict, the role of climate change and extreme weather, headwinds resulting from the inflation trajectory, labor market imbalances due to aging population and productivity challenges, and the role of technology innovation and accessibility.

What is the five-year economic outlook?

Developments over the past 15 years—the Great Recession, the COVID-19 pandemic, the war in Ukraine, and resultant shocks to energy and inflation—have disrupted the global economy in fundamental ways. As one participant at the 2023 CEO Retreat warned, “we could be entering a lost decade. …. Will we have the stability to go through the recession that’s needed to bring inflation under control?” This remains an open question given fragilities in the system, including high levels of debt across sectors and countries, higher debt-servicing levels, acute economic vulnerabilities in emerging and developing countries, and mounting political challenges—from rising populism to a fragmentation of longstanding global institutions. Foundational ideas, including the superiority of open markets, liberal trade, and maximum efficiency, are all in question right now in the turbulence of the immediate post-COVID world.

Indeed, in a word, the five-year economic outlook is “lackluster.” While growth will tick upward in 2025, the average growth rate out to 2027 is lower than our forecasts from 1H 2023. Lower-than-anticipated growth in China, along with structural factors such as persistent inflation, possible additional monetary tightening, and labor market challenges, weigh on the outlook. A retreat from globalization—though perhaps not as pronounced as many analysts have feared—will dampen the economic outlook as protectionism grows.

When will the global economy begin to see renewed growth?

In our 1H 2023 Outlook, we projected growth of 1.8 percent this year. As of September 2023, the outlook for 2023 has improved—to 2.5 percent. Significant headwinds remain, however. We are expecting to see annual average global output growth of 2.6 percent over the 2023–2027 forecast period, compared with 2.7 percent in our previous projections (see figure 1).

While a slight uptick in growth is anticipated in 2025, the longer-range global economic outlook is still anemic. Several factors account for this persistent low-growth story.1 First, China—which in recent years has typically been the engine of global growth alongside India—is expected to underperform relative to previous projections. Second, while the global services Purchasing Managers Index has surged, the manufacturing index remains in contraction territory.

The International Monetary Fund (IMF) is treating the five-year outlook with similar caution. Its July 2023 World Economic Outlook Update echoed the expectation that China’s recovery could slow, in part as a result of unresolved real estate problems, which could in turn have damaging cross-border spillovers. Sovereign debt distress could also spread to a wider group of economies, including Egypt, Jordan, and Tunisia. However, factors to the upside include the strong action by authorities to contain turbulence earlier this year in the United States and Swiss banking sectors—which reduced the immediate risks of financial sector turmoil. And inflation in key markets, including the United Kingdom and France, could fall faster than expected, boosting growth prospects.

What are the expectations for inflation, and where will interest rates land?

Inflation is projected to recede in most major economies because of weaker commodity prices, slowing growth, and an improving supply chain. However, the speed and pace of decline could vary from country to country based on domestic supply and demand factors along with the timing of policy tightening. Of note, for most economies, headline inflation is unlikely to fall to target levels by Q4 2024. Average inflation forecasts from 2023–2027 for both advanced and emerging economies are higher than those anticipated in our 1H 2023 Outlook (2.4 percent versus 2.2 percent for advanced economies and 5.7 versus 5.0 percent for emerging markets) (see figure 2).

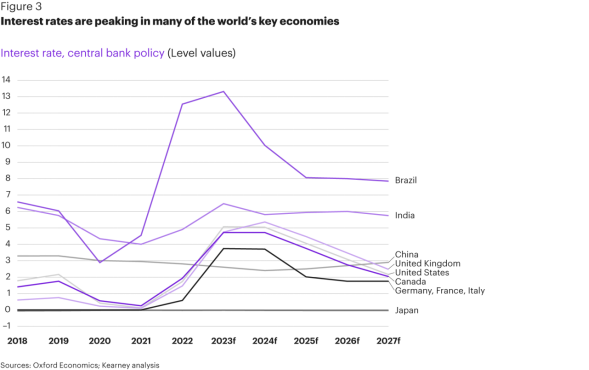

Indeed, central banks remain focused on pushing back inflation to target levels with interest rates that are likely close to peaking (see figure 3). To avoid further inflation spikes, they are expected to continue proceeding cautiously by keeping tight monetary policies.

What is the employment outlook?

Global unemployment is forecast to decrease marginally over the forecast period, landing at an average of 6.5 percent (see figure 4). According to the International Monetary Fund, if core inflation falls faster than expected and declining job vacancies play a strong role in easing labor markets, unemployment would not necessarily have to rise to curb inflation. This could lower the requirement for monetary policy tightening and allow a softer landing for the global economy overall.

There are, however, multiple downside risks to the global labor market. Indeed, the International Labor Organization (ILO) notes that the working-age population has started to shrink in a number of major economies. China’s working-age population is projected to fall by more than 20 percent to some 700 million by 2050, after peaking at 900 million in 2011. Further, by 2050, the number of working-age people in South Korea and Italy is also expected to decrease by 13 million and 10 million respectively. And old-age dependency ratios—defined as the ratio of the population aged 65 and above to the population aged 15 to 64—have risen significantly over the past decade in many high-income countries and upper-middle income countries, slowing labor productivity growth.

Conversely, low-income and lower-middle-income countries are projected to see their combined labor force grow by around 30 million people per year until 2024, mostly as a result of young people entering the labor market. For example, according to the ILO, Africa is projected to account for almost half of the global labor force expansion (16 million workers per year) while accounting for only a fifth of the global labor force.

Research from the World Economic Forum (WEF) suggests that technology will play a central role in overcoming some of these imbalances. Big data analytics, climate change and environmental management technologies, and encryption and cybersecurity are projected to contribute most heavily to job growth. That said, digitalization and automation will be key drivers of job losses—amounting to up to 26 million positions by 2027, according to surveyed organizations—namely in administrative, traditional security, factory, and commerce roles.

What will the largest economies be by 2027?

The order of the world’s top 10 largest economies in 2027 will change over our forecast period (see figure 5). China will continue to close the GDP gap with the United States—but will not surpass it as the world’s largest economy. Canada will remain in the 10th position, both in 2023 and 2027. Updated forecasts show that South Korea no longer makes up the top 10 economies during either year, likely owing to continued challenges resulting from weak exports.

Perhaps most notably, India is still expected to surge from sixth place to fourth, overtaking the United Kingdom and Germany. As was explored in our 1H 2023 Outlook, India continues to benefit from surging investment and robust exports. Government reforms have reduced corporate tax rates, strengthened insolvency and bankruptcy codes, and deregulated hydrocarbons, railways, and ports. India overtook China as the world’s most populous country this year, boosting its labor market. And trends suggest that by 2050, the country’s population will reach 1.7 billion. The EIU also estimates that India could see its spending power rise from representing just 3 percent of that of a US consumer to 24 percent by 2050.

Though China is still experiencing obstacles as it emerges from its zero-COVID policy, by 2027, it is forecast to close most of the output gap with the United States from around $4.4 trillion to about $2.4 trillion. According to Oxford Economics, underperformance in Q2 prompted policy easing announcements, though debt levels remain elevated. Baseline projections suggest a moderate improvement to growth in the second half of the year, bringing 2023 growth to just above the government’s formal target of 5 percent. While the United States will remain the world’s largest economy through the forecast period (and well beyond, we believe), levels of geopolitical risk between the two countries are likely to rise as the balance of economic power between them narrows through 2027 and beyond.

What is the trajectory of globalization?

In the Council’s 2023 Foreign Direct Investment Confidence Index (FDICI), we polled investors on their thoughts on the state of globalization. The findings suggest that a distinct majority of respondents (66 percent) anticipated an increase in globalization in the next three years; by contrast, only 23 percent expected a decrease. Those expecting an expansion of globalization cited a combination of connected digital infrastructure alongside growing trade opportunities and limited trade barriers as the primary driving forces. This is likely the result of the striking proliferation in digital trade and services, especially for telecom and IT, which took place during the pandemic and the rebound in trade writ large beginning in 2021.

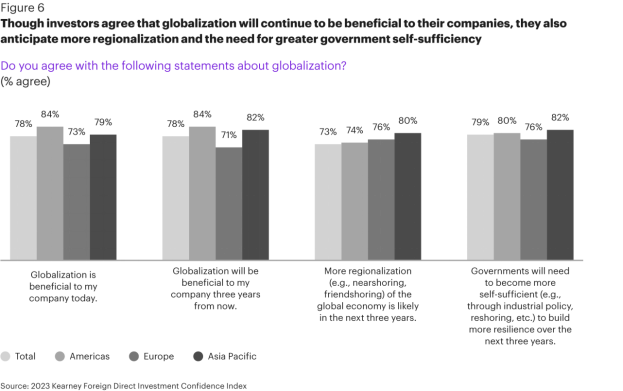

However, while these results indicate that investors believe in the benefits of globalization and expect it to strengthen, they also expected more regionalization over the next three years and that national governments will pursue strategies to become more self-sufficient (see figure 6). These figures suggest an awareness that while globalization will continue, its nature may shift as regionalization and policies to strengthen self-sufficiency proliferate.

The views expressed at our 2023 CEO Retreat in Cannes suggested a more challenging outlook for globalization. The CEOs and thought leaders at the Retreat raised concerns that a rise in populism and backlash to long-established Western institutions in both Europe and the United States appear to be slowing globalization. One participant noted “after the Cold War, states were called on to sacrifice part of their sovereignty for international institutions. Today, the world is fragmenting again, and multilateralism is breaking down as countries are trying to reclaim their sovereignty.” Another noted “what we are experiencing is not the end of globalization, but definitely the end of hyper-globalization”—the period of rapid expansion of globalization from 1991–2008.

This question remains up for debate. At the March 2023 China Development Forum, IMF Managing Director Kristalina Georgieva warned that “uncertainties are exceptionally high, including because of risks of geo-economic fragmentation, which could mean a world split into rival economic blocs—a ‘dangerous division’ that would leave everyone poorer and less secure. Together, these factors mean that the outlook for the global economy over the medium-term is likely to remain weak.” This musing is backed by data. Indeed, US goods imports from China fell 25 percent during the first six months of 2023 as companies looked to other countries to de-risk and diversify their supply chains amid rising tensions between Washington and Beijing. As supply chains continue to be rewired in an atmosphere of rising geopolitical risk, it is possible that production will be moved closer to home in many countries—or reshored entirely—precipitating an even greater retreat from globalization.

Which regions will drive economic output?

While uncertainty around the outlook for globalization remains, there is no question that all three major engines of the global economy—the United States, China, and Europe—are slowing down, contributing to the broader decline in global output. Even with these headwinds to global growth, Asia and Australasia will continue to lead the world in output growth, averaging 4.1 percent growth through 2027 (see figure 7). India and China—despite recent slowdowns—remain the key to regional success.

India has seen a remarkable reduction in poverty and an equally remarkable improvement in life expectancy over the past 30 years, fueling a demographic shift and economic growth. Our growth projections for India have increased since our 1H 2023 Outlook, rising from 6.7 to 7.0 percent over the forecast period. India’s GDP is set to skyrocket amid its aforementioned population boom, boosted by innovation and technology developments, which include a scaling up of manufacturing and services, and initiatives to encourage semiconductor manufacturing, and renewable energy development. As such, growth is expected to surge to a high of 7.9 percent in 2025.

China maintains its position as the region’s second fastest-growing major economy, with a projected 2023–2027 average annual growth rate of 4.7 percent. This represents a slight decline from our 1H 2023 Outlook projection of 4.8 percent. The country is losing momentum due to several hurdles that contributed to a slow COVID-19 recovery, including real estate market contractions, public debt pressures, weaker consumption, fiscal tightening, and negative spillovers to the rest of the world, impacting global supply chains. Even so, some sectors, such as tourism and entertainment, are showing signs of recovery as the post-pandemic reopening continues and as investment levels and infrastructure growth are restored.

Outside of the two largest economies in the region, other fast-growing countries in Southeast Asia, such as Vietnam, Indonesia, and Malaysia, maintain positive prospects but may be bogged down by the threat of sovereign debt default. Japan and South Korea are set to experience lower growth through 2023–2024, but slight uplifts through 2025–2027 lend a note of optimism. Our 1H 2023 Outlook anticipated a slightly faster recovery for these countries, but these projections have since been revised downward. Japan, for one, grapples with the challenge of restoring fiscal health, rising prices, persistent inflation, and demographic pressures. The country’s output is expected to average 1.0 percent through the forecast period, down from 1.3 percent in our previous outlook. And while Australia has seen a slight improvement in average 2023–2027 growth projections from 2.6 to 2.7 percent since our 1H 2023 Outlook, this still suggests modest dynamism.

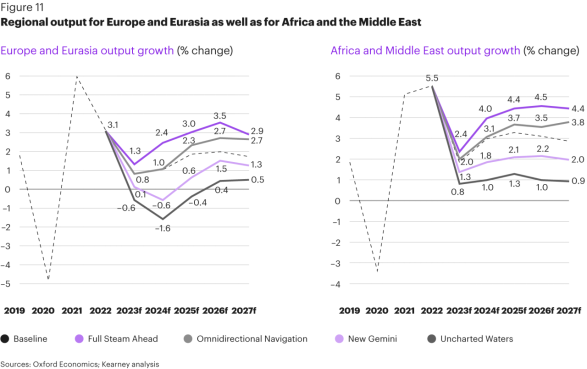

In Europe and Eurasia, a confluence of challenges is slowing growth. The region lags the others in terms of their outlook with an average of 1.5 percent output growth over the forecast period. Though regional growth appears more optimistic in the short term compared with the previous projections, it remains anemic in 2023 and 2024, at just 0.8 and 1.0 percent respectively. Growth rebounds slightly in 2026 and 2027 but remains under 2 percent. Despite persistent uncertainties, particularly related to geopolitics and security matters, there are pockets of strength in the eurozone economy that continue to serve as growth engines for the region. Countries such as Ireland, Poland, and Greece, for example, are outperforming the usual regional powerhouses in terms of year-over- year output.

However, regional instability related to the war in Ukraine, threats of financial market challenges, weakness in manufacturing, and continued high inflation will continue to contribute to slow regional growth. Since our 1H 2023 Outlook, the average annual growth from 2023–2027 for France, the United Kingdom, Russia, and Germany has declined, primarily owing to these challenges. France, for example, had a projected average growth of 1.7 percent across 2023–2027 earlier this year, but this has since fallen to 1.4 percent. The war in Ukraine, supply chain disruptions, high energy prices, low business confidence, and unsupportive fiscal policy are the driving forces behind this drop. Indeed, risks in the region are often interconnected, compounding the effects of the broader regional issues, including financial sector risks, tight monetary policies, sticky inflation, and geopolitical instability.

Despite these headwinds, some bottlenecks are easing, and the region is positioned to be a source of steady though subdued growth moving into 2024 and beyond. Though high, inflation is declining, and countries avoided a winter recession owing to government relief measures. There are also some economic bright spots in Eastern Europe, notably Poland, which is projected to experience an average of 2.2 percent growth across the 2023–2027 forecast period, compared with the more modest 1.5 percent growth of the broader region, due to its resilience and competitive business environment.

A modest improvement to growth in the United States is expected to improve forecasted output in the Americas. The outlook anticipates a softer landing for the United States following the period of high inflation in 2021–2022. Average GDP growth for the country has increased 0.1 percent since our 1H 2023 Outlook to 1.6 percent over the 2023–2027 forecast period. As a result, the broader region is expected to see a matching uptick in the average output growth over the 2023–2027 forecast period, rising from 1.6 percent average output growth in our April outlook to 1.7 percent. The US economy is doing better than expected, largely driven by a strong labor market recovery and declines in inflation that are outpacing those in comparable markets. However, key challenges persist. Despite improvements, inflation remains above target levels, lending standards are tighter, as are monetary and fiscal policies, and supply chain challenges endure2. Growth is likely to slow to just 0.2 in 2024 before rebounding modestly to 1.6 percent in 2025.

Latin America is facing a range of challenges. External uncertainties and policy restrictions are poised to create headwinds to growth across the region’s largest economies over the next two years. However, heading into 2025–2027, GDP output is projected to regain momentum. Mexico and Brazil’s improving growth will help boost regional output in the later part of the forecast period. In Mexico, our H1 2023 outlook projected average 2023–2027 growth of 1.9 percent, but this has been revised upward to 2.1 percent. Consumption is strong in Mexico, fueled by improvements in the labor market and higher wages. As more manufacturing moves to Mexico and the country benefits from investments in global value chains, growth is projected to rise. Brazil is also projected to experience an increase to GDP growth heading into 2025–2027, rising from just 0.3 percent in 2024 to 2.2 percent in 2025, driven by reforms in the infrastructure sector and a revival of political interest in the green agenda under a new administration. However, several obstacles to growth remain, including the persistent inflation, reduced global demand, and the effects of monetary tightening.

The outlook in the Middle East and Africa continues to reflect consistent, though delayed, growth. Projected regional growth has risen slightly since our 1H 2023 Outlook from 2.7 percent to 2.8 percent. Saudi Arabia sees the most significant uptick in projected growth, rising from 2.4 percent in our previous outlook to 3.2 percent average annual growth between 2023–2027. The Kingdom has benefitted from strong oil production and sizable private investment in non-oil areas such as wholesale, retail trade, construction, and transport, alongside low inflation and low unemployment. Oil and gas exporting countries in the Middle East and North Africa have reaped the economic advantages of strong demand, and this is expected to continue throughout the forecast period. Longer-term changes in oil and gas export demand may introduce volatility and could force a shift toward diversification.

Elsewhere in the Middle East and Africa, high inflation and rising food and oil prices continue to pose challenges, further dividing high- and low-income countries in the region. However, leveraging natural resources, securing private-sector financing, and investments in sustainable agriculture and land restoration will all factor into advancing Africa’s outputs. Investment in green growth, including green technologies and agribusiness could help unlock this private sector financing and boost regional growth through the forecast period. For example, the United Nations projects that renewable energy solutions could create a 6.4 percent increase in African GDP across 2021 to 2050.

What key factors will shape the economic outlook through 2027?

Over the next five years, a few factors could have a disproportionately large impact on the direction of the global economy:

Geopolitical turbulence. The risk of further fragmentation and conflict in the global operating environment persists. The threat of escalation in the Ukraine conflict, uncertainty in US–China relations, and the potential global ripple effects of the 2024 presidential election in the United States are just a few of the wildcards that will shape geopolitics through 2027. Though Democrats and Republicans are aligned on a few geopolitical issues, such as the strategic rivalry with China, protecting domestic manufacturing, and access to strategic technologies, key areas of disagreement include climate change action, the war in Ukraine, and the relationship with traditional US allies.

Role of climate change and environmental pressures. July 2023 saw multiple global temperature records broken. And new data from the World Resources Institute’s Aqueduct Water Risk Atlas shows that 25 countries—housing one-quarter of the global population—face extremely high water stress each year, frequently using up almost their entire available water supply. These climate issues are combining with critical mineral shortages, with implications for the energy transition. To avoid critical minerals shortages, an estimated 330 new mines are needed over the next decade, including 59 lithium mines. For context, the world currently has about 25. Global cooperation to confront these and related climate challenges will be crucial but is far from a foregone conclusion.

Inflation trajectory. While levels of inflation have fallen from their heights in 2022, they remain stubbornly high. Remarkably, regulators and central banks were able to contain the contagion from the collapse of Silicon Valley Bank and other US regional banks, as well as Credit Suisse in Switzerland, without impeding their efforts to reduce inflation. However, they still face significant headwinds in the near term. The key challenge for policymakers will be how to meet their targets of 2 percent inflation without pushing their economies into recessions in the process. Indeed, in the words of Federal Reserve chief Jerome Powell, “The longer inflation remains high, the more risk there is that inflation will become entrenched in the economy. So the passage of time is not our friend here.”

Labor market imbalances. Other than the dynamics of aging populations in certain advanced economies and the high proportion of young people in many emerging markets discussed above, persistent global productivity challenges remain. Total hours worked has rebounded less well after the COVID-19 crisis than has employment, with hours worked per worker having persistently declined. The low level of hours per worker in low-income countries is directly related to the lack of good work opportunities. And globally, employed women work around seven paid hours per week fewer than men, with notable degrees of variation of that gender gap by region. As high inflation continues to weigh on income levels, these labor market imbalances—and associated inequalities—risk becoming more pronounced.

Technology innovation and accessibility. Since the release of our 1H 2023 Outlook, technology innovations have continued to advance at a striking pace. Generative AI tools such as ChatGPT and others are proliferating, with one participant at our 2023 CEO retreat arguing that generative AI could see the world accumulating “a 10-fold increase in GDP, valued at some $14 quadrillion … [which] could result in a better civilization.” As striking and as promising the economic gains of generative AI may be, significant potential risks are also associated with the technology—and regulatory guardrails are lagging. Further, the intensifying US–Sino decoupling in critical technologies amid rising protectionism and industrial policies are continuing to fragment the global economy. As technology advances, in areas such as AI, machine learning, quantum computing, and beyond, risks may be mounting of a world divided by tech “haves” and “have-nots.”

Where might we be going?

To account for the high degree of uncertainty in economic outlook, we developed a set of four complementary scenarios for our 1H 2023 Outlook. These scenarios—alternate and contrasting visions— of the macroeconomy through 2027 served to complement our baseline projections. For our 2H 2023 assessment, we have revisited this set of scenarios and refreshed our analysis to account for developments over the past six months, as well as dynamic changes in the five factors we believe will shape the economic outlook. While the four narratives that follow are not predictions, as a set, they represent a plausible range of potential futures around which strategic leaders can plan.

· In Uncharted Waters, the combination of geopolitical and economic dislocations creates significant drag on the global economy.

· In New Gemini, a bipolar world emerges as the United States and China accelerate economic decoupling and spheres of influence emerge, a transition that results in below-trend output growth.

· In Omnidirectional Navigation, a fragmentation of global trade and investment flows ultimately leads to a rewired global economy requiring greater agility and resilience. Global output exceeds baseline projections.

· And in Full Steam Ahead, the United States, China, Europe, and other key players work to refresh and revitalize the global economic order through strategic institutional reforms that help to stabilize the foundations on which the global economy is built—and growth rebounds significantly.

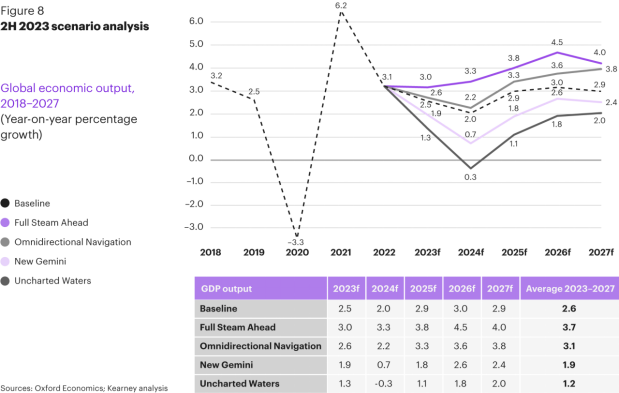

By using modeling, we have quantified the impact of each of these scenarios on global and regional growth. As noted above, baseline projections suggest global growth will average 2.6 percent over the five-year forecast period. Yet our analysis finds that this number could range from as low as 1.2 percent to as high as 3.7 percent, depending on how effectively the world can address the aforementioned factors shaping the global economy (see figure 8).

Our research also suggests that key indicators such as unemployment rates, exports, and private consumption will also vary dramatically (see figure 9). Unemployment rates range from a five-year average of 5.8 percent in the best-case scenario, Full Steam Ahead, to 7.4 percent in the worst-case scenario, Uncharted Waters. And the export growth rate ranges from a five-year average high of 4.8 percent to a contraction of 1.0 percent respectively. Finally, private consumption reaches a five-year best-case average growth rate of 5.0 percent compared with just 0.4 percent in the worst case.

Vision 1: Uncharted Waters

A global economy defined by high volatility

In Uncharted Waters, the world is sailing into an uncertain future. Geopolitical fractures intensify through 2027, particularly as the Russia–Ukraine war intensifies and US–China relations deteriorate. The threat of large-scale physical and cyber conflict looms, especially as the United States appears more divided and distracted in the lead up to and aftermath of its presidential elections in 2024. Rising hostilities between Washington and Beijing also serve to weaken international efforts at conflict resolution, stoking dormant tensions elsewhere in the world.

Inflation proves enduring after central banks ease too early on the necessary and aggressive monetary policies they put into place in early 2023, prompting a resurgence of inflation and stop–start cycles of rate increases. Further, extreme weather and other climate-related shocks continue to interrupt production, disrupt supply chains, and impose high costs. The effects are felt most acutely in energy and commodity markets, increasing prices for consumers and placing additional strain on heavily indebted emerging markets. The high cost of energy, as well as food and other necessities, fuels popular unrest and government instability.

Labor shortages, though somewhat mitigated by lower growth, continue to challenge many economies, especially in major developed countries such as the United States, Japan, United Kingdom, Germany, and Australia, amid aging populations. The rise of populist leaders and anti-immigration sentiment serves to compound many of these challenges and create further drags on productivity. For many emerging markets with large youth populations, including those in sub-Saharan Africa and the Middle East, limited job opportunities in a low-growth economic environment create additional governance challenges as popular dissatisfaction grows.

Persistent supply chain disruptions combined with limited cross-border exchanges of people and ideas slows the rate of technology innovation. A splintering of technology ecosystems, starting with a split between China and the United States, serves as an additional complicating factor to technology innovation and governance. Both countries face obstacles in their race to “win” the race for AI, with China suffering from restricted access to semiconductors and the United States scrambling to find alternative sources of rare earth minerals and other raw materials as China restricts access.

Taken in combination, the global economy finds itself in Uncharted Waters—a landscape fraught with inefficiencies and volatility, prompting corporations and investors to stay closer to home amid dwindling opportunities abroad (see figures 10 and 11). Growth averages just 1.2 percent through the forecast period.

Vision 2: New Gemini

A bipolar world

In New Gemini the world divides into two distinct spheres of influence—one led by the United States, the other by China. As both powers move to decouple their economies from one another and as other countries face pressures to “take sides,” there are significant disruptions to global supply chains and the overall efficiency of the global economy. The United States strengthens ties with longstanding allies in the European Union as well as with countries in Asia Pacific, including Japan, South Korea, and Australia. China’s strategic partners include Russia, several Arab Gulf states, and many developing countries across Latin America, Africa, and Southeast Asia, while India seeks to balance relations with both spheres and maintain neutrality. While geopolitical relations between Washington and Beijing remain strained throughout the decoupling process, the threat of imminent conflict recedes as the world recalibrates to the relative predictability of this new bipolar world. A temporary ceasefire amid negotiations in the Russia–Ukraine war, combined with a US presidential election that is less disruptive than anticipated, serve to ease geopolitical tensions.

Inflation falls from the highs experienced in 2022 as central banks successfully carry out monetary policy tightening without sending major economies into recession. However, reaching 2 percent targets remains elusive as the rewiring of supply chains places upward pressure on prices. In the race to AI supremacy, the United States maintains a competitive advantage over China as the latter struggles with limited access to advanced US technologies and semiconductors produced in the US sphere of influence. China remains a leader in the production and refining of rare earth elements and imposes some limitations on—though does not stop—exports to rivals. In parallel, the United States makes positive strides to improve domestic production of semiconductors and find alternative sourcing options for critical minerals, offsetting some of the losses from decoupling. However, the bifurcation of US and Chinese technology complicates cross-border exchanges of data, digital services, key technological goods, and talent. Technology standards also diverge between these two spheres, complicating companies’ ability to serve competing markets across geographies.

In this environment, global energy and commodity markets see limited to moderate volatility. While there are supply disruptions owing to the decoupling process and instances of extreme weather, reduced demand in a lower-growth environment combined with an overall reduction in geopolitical tensions help to mitigate these factors. Labor markets generally remain tight, albeit reconfigured by disruptions to the free flow of labor across the respective spheres of influence. The United States and China, as well as other markets, compete aggressively to build a “workforce of the future,” resulting in a race to both recruit talent and build it domestically. Despite initial dips early in the forecast period, labor productivity rebounds by 2027 as markets are rewired in New Gemini. While there is below-trend economic output for most of the forecast period, averaging 1.9 percent, the global economy—and the world—reach a new state of equilibrium by 2027.

Vision 3: Omnidirectional Navigation

A world defined by fierce competition and growing fragmentation

In Omnidirectional Navigation, the global economy fragments into several different hubs of economic and political power. The world is defined by shifting blocs and trading partners amid high levels of competition as countries strive to lead in innovation, technology, and other areas. While the United States, China, and the European Union remain major centers of economic power, middle power players emerge in an increasingly multipolar landscape. India, Turkey, several Arab Gulf states, and Singapore, for example, serve as strategic trading hubs with a diverse set of partners.

While no one hub emerges to dominate the others, the emphasis on greater trade and the cross-border exchange of goods, services, and people serves to temper broader geopolitical tensions. These developments help to offset labor market imbalances and enhance productivity gains by allowing for the greater flow of young workers from emerging markets to developed economies with aging workforces. However, other developments complicate the landscape. A divisive 2024 US election results in a divided government and a weakened president, with limited scope to implement a clear policy agenda. This lack of clear geopolitical leadership contributes to an effective stalemate of the Russia–Ukraine war, with neither side garnering the economic or military strength to effectively make significant territorial gains. The result is a frozen conflict.

In some ways, the world that emerges from this mix of fragmentation, and trade represents a new iteration of globalization—a mix of traditional approaches with a wider variety of partners, combined with some degree of protectionism to improve domestic resilience. For example, US–China competition remains fierce with an acute focus on economic factors, albeit with some persistent restrictions around sensitive advanced technologies. With this notable exception, cross-border technology flows are generally strong, and the environment of fierce economic competition spills into the race for next generation technologies, including AI. The United States, China, and the European Union all invest heavily into R&D—and to set new regulatory standards. The race for innovation, coupled with higher than baseline growth, help to facilitate advances in the energy transition. These dynamics, combined with the open cross-border flow of goods, serve to mitigate energy and commodity market volatility.

In this multifaceted and complex economic operating environment, it takes some time for inflationary pressures to ease as supply chains and investments are reconfigured. Despite some short-term inefficiencies, central banks are generally successful in advancing accommodating monetary policy and maintaining economic stability.

In Omnidirectional Navigation, a rewired global economy emerges from the fragmented landscape, with supply chains and investment flows increasingly localized and regionalized in nature. Countries that demonstrate agility in balancing economic ties with a range of partners across several spheres of influence outperform economic expectations. Output growth averages 3.1 percent over the forecast period.

Vision 4: Full Steam Ahead

A refresh of global economic organization

In Full Steam Ahead, global powers, including the United States, European Union, and China, seek a geopolitical reset. This begins in earnest following decisive results in the 2024 US presidential elections and a push from the US administration to reduce tensions and return the global economy to stability. International efforts strive to rebuild the global linkages damaged during the COVID-19 pandemic, though with an eye on resiliency for certain strategic sectors. Global leaders pay particular focus on modernizing the rules, norms, and institutions that govern the global economic order, including reforms to the Bretton Woods Institutions.

While levels of distrust and some diverging trade and economic practices remain, there are notable increases in trade and investment flows over the course of the forecast period. A balance is struck in enacting policies to achieve greater domestic self-sufficiency. After periods of bilateral negotiation, countries are generally able to reach consensus on appropriate subsidy levels for critical domestic industries. Notably, the United States and European Union come to a mutual understanding on climate and industrial policies and reduce tensions they experienced in 2022 and 2023.

Yet following a string of increasing extreme weather events, it is evident that developing and implementing a global response to climate change is the leading challenge for world leaders. Despite lingering distrust, the United States and China build on efforts by the European Union in this strategic area, with a specific focus on clean energy technologies. Technology competition between the United States and China remains fierce in strategic areas, including AI, advanced semiconductors, and quantum computing, but exceptions are made for climate-related technologies. The exchange of goods, services, and expertise in this sphere expands the deployment of solar, wind, electric vehicles, and related technologies. The potential for nuclear fusion as a viable power source also grows in a tech innovation-friendly environment, fueled by increased global growth and expanded scientific and academic cooperation. This, coupled with more predictable supply chains and a calmer geopolitical environment, reduces global energy market disruptions.

Businesses benefit from a stronger degree of predictability in the global operating environment. Labor market imbalances in many countries also ease as demand smoothens, immigration remains open, and technology improvements boost automation. Levels of productivity tick up throughout the forecast period. Further supporting this higher degree of predictability are central banks, which are largely able to stabilize their economies in 2023 and 2024 through tightened monetary policies while maintaining healthy levels of growth. Levels of inflation fall, approaching 2 percent targets by mid-decade. Financial institutions respond favorably to these policies, tightening lending standards while keeping markets liquid and sound.

Overall, the global economy is on relative steady ground by 2027, bolstered by a refreshed and revitalized system of rules-based order. With a reduced likelihood of geopolitical conflict, there is reason for optimism that growth and development can continue to charge full steam ahead on this new foundation. Output growth averages 3.7 percent through the forecast period.

Conclusion and implications for business

While any one of these scenario outcomes is possible, our baseline analysis suggests that low-trend growth will likely characterize the years ahead. Geopolitical instability, environmental pressures, persistent inflation, and labor market imbalances all continue to dampen the outlook. These and other fragilities will likely strain globalization as countries react to uncertainty with industrial policies, decoupling, and moves to enhance domestic self-sufficiency. A note of caution underpins the overall outlook, and companies should take it into account in their planning.

However, there are a few bright spots. India and the broader Asia region continue to drive growth, suggesting a continuing role for Asia as a key economic and political powerhouse. The rapid pace of technology development has the capacity to accelerate productivity and innovation, potentially counteracting some labor market imbalances. And inflation and global unemployment are set to stabilize by late 2024/early 2025.

To help businesses best respond to these changes in the short and long term, we have identified four implications to address the shifts in the global operating environment:

Lean into volatility. High levels of uncertainty and the greater geopolitical and economic fragmentation are highly likely over the next five years. As the title of this report suggests, strategic businesses will continue to invest in new ventures, diversify markets, and pursue innovative solutions rather than shrinking operations and falling into a defensive crouch. Such actions will build resiliency, create additional business opportunities, and drive growth.

Develop risk preparedness. In tandem, strategic businesses will continue to prioritize operational resiliency. Building and maintaining capacity in risk preparedness and management programs will be crucial. Such programs can help mitigate the impact of outside shocks, from minor inconveniences such as shipping delay times to worst-case scenarios ranging from another pandemic to cybersecurity threats to a major conflict.

Embrace innovation. Businesses that demonstrate agility in how they incorporate and leverage technologies such as AI, quantum computing, and machine learning will hold a competitive advantage. This includes building an understanding of which new tools to embrace and how to deploy them. Training to build the new generation of tech-savvy workers will be another strategic priority as persistent talent shortages may hinder the ability of firms to implement and use new technology.

Find opportunities in push to meet environmental standards. Scenario projections through 2027 that include global efforts to address climate change are those that experience the highest growth rates. Innovations such as climate management technologies are likely to flourish in this market. Firms that embrace climate-friendly practices, develop climate-friendly innovations, and incorporate environmental risk-management practices early on will be best positioned to contend with the effects of climate change.

1 Oxford Economics’ World Economic Prospects Monthly, 8 August 2023

2 Oxford Economics’ World Economic Prospects Monthly, 8 August 2023

The authors would like to thank Gabriella Huddart and Kathleen Harrington for their valuable contributions to this report.

Authors

Erik R. Peterson

Partner and Managing Director, Global Business Policy Council

Terry Toland

Consultant, Thought Leadership, Global Business Policy Council